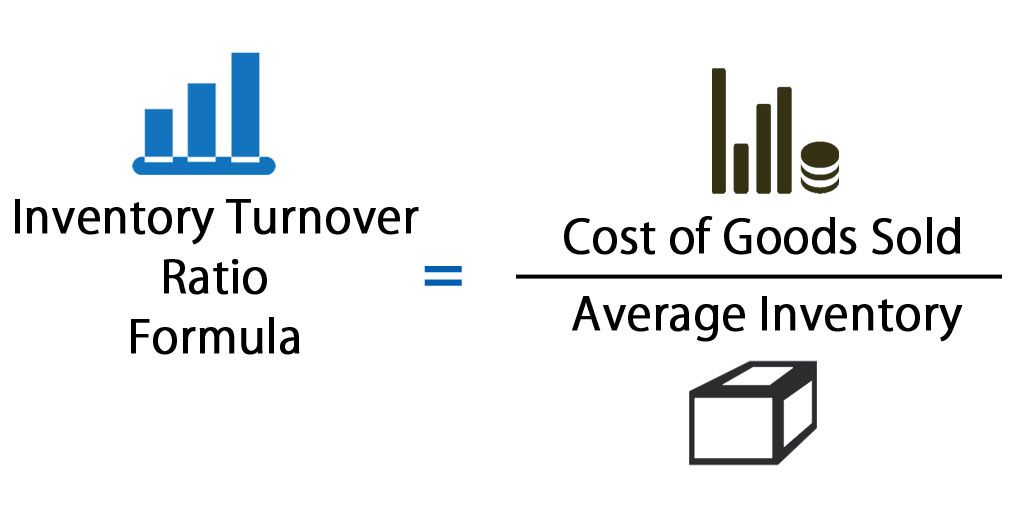

A turnover rate above one indicates that the items the firm sells fit the current market needs. If a company has a turnover rate of one or less, it has more inventory than current consumer market demands. To calculate a company's inventory turnover ratio, divide the company's cost of goods sold (COGS) by its average inventory. Inventory turnover can help investors determine the potential risk they may take when investing funds in a company. A low inventory turnover may imply that a company is struggling to move its products, which may lead to financial difficulties. A high inventory turnover rate shows that a company is selling its products and services. The inventory turnover or stock turn ratio measures how frequently a company sells and replaces its stock of goods in a specific time frame. Turnover is also a key business performance indicator, as it measures how quickly a company collects on its accounts payable. Companies document their transactions on their balance sheet, and the accounts receivable turnover ratio provides insight into a company's credit and collection policy. It measures how many times a company's receivables turn over or the number of cycles they have in a given period. The receivables or accounts receivable turnover ratio is the amount of money customers owe to a company for their goods or services.

The three main types include: Accounts receivable turnover ratio There are several types of turnover ratios, and they all provide an insight into a company's operations.

Turnover meaning how to#

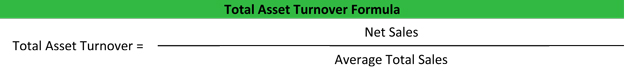

Related: How to Use a Return on Assets Formula (With Examples) Types of turnover ratios Turnover is also an essential metric in investing, as it indicates how fast a firm sells its portfolio in a given month or year. Companies use turnover to understand how quickly they collect money due to them and the average rate at which they sell inventory.

It shows how well a company is performing and whether it's growing or shrinking. Sales, revenue, or business turnover is a measure of how much money a company generates through the sale of its products or services in a specific time frame. In this article, we define business turnover, list the different types of turnover ratios, explore their importance, and explain the various calculation methods. Understanding what different turnover ratios mean can help you detect areas in need of improvement or maybe help you identify the potential risk of investing in an organization. With this information, a company's leadership can make decisions that typically help them achieve their financial and operational goals. Companies and financial professionals use various business turnover ratios to determine their operation's fiscal health or indicate potential investment opportunities.

0 kommentar(er)

0 kommentar(er)